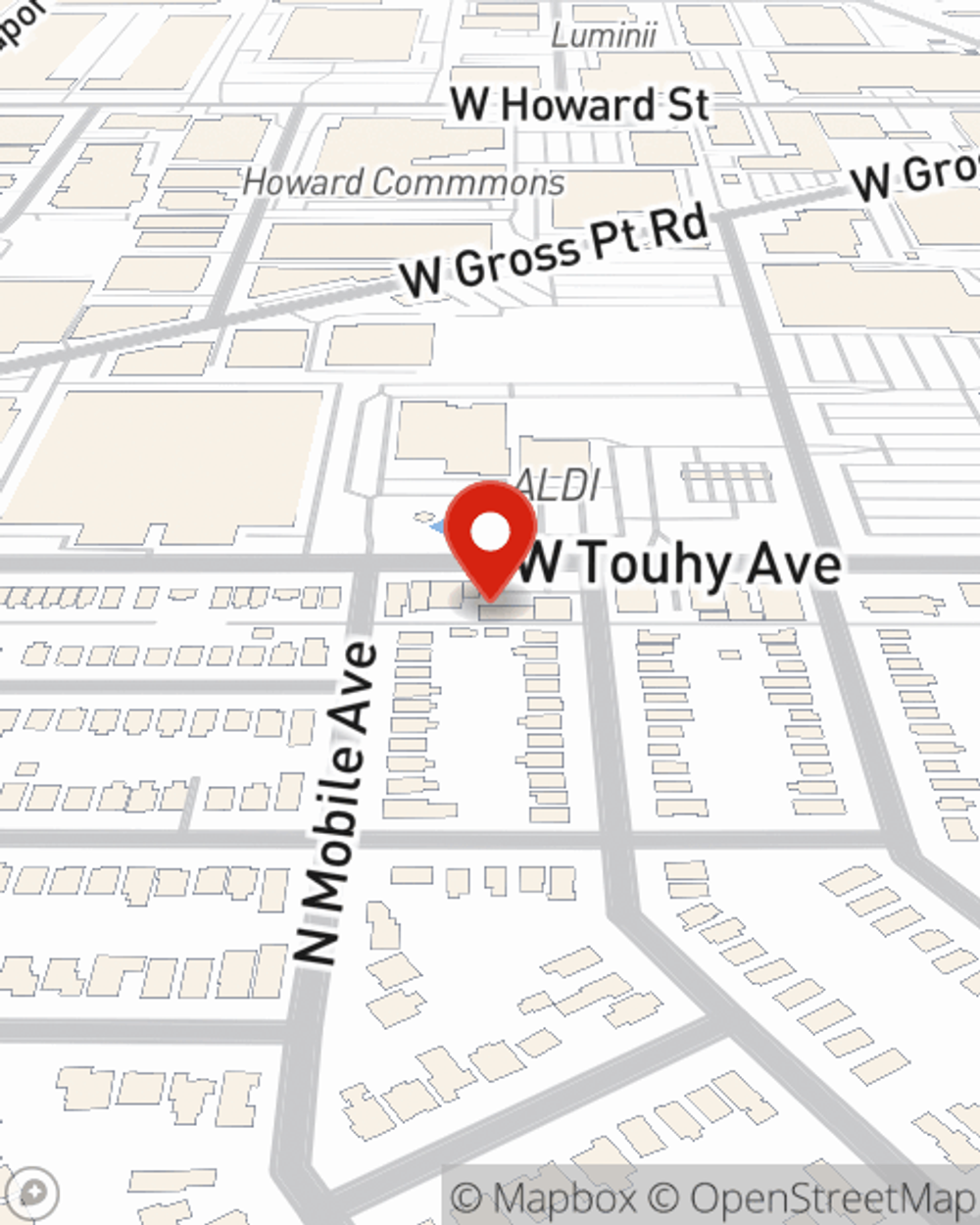

Renters Insurance in and around Chicago

Chicago renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Would you like to create a personalized renters quote?

There’s No Place Like Home

No matter what you're considering as you rent a home - size, location, number of bathrooms, condo or townhome - getting the right insurance can be important in the event of the unexpected.

Chicago renters, State Farm has insurance for you, too

Renting a home? Insure what you own.

Safeguard Your Personal Assets

The unpredictable happens. Unfortunately, the valuables in your rented townhome, such as a video game system, a guitar and a cooking set, aren't immune to theft or smoke damage. Your good neighbor, agent Michael Johnson, is ready to help you understand your coverage options and find the right insurance options to insure your precious valuables.

It's never a bad idea to make sure you're prepared. Get in touch with State Farm agent Michael Johnson for help getting started on coverage options for your rented property.

Have More Questions About Renters Insurance?

Call Michael at (773) 756-0004 or visit our FAQ page.

Simple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.

Michael Johnson

State Farm® Insurance AgentSimple Insights®

Personal property and casualty insurance

Personal property and casualty insurance

What is Personal Property and Casualty Insurance? Learn more information on automobile, homeowners, watercraft, condo, renters and more.

How does a home insurance deductible work?

How does a home insurance deductible work?

Learn how the homeowners insurance deductible chosen can make a difference with your homeowners premium.